Introduction

Secure and compliant open banking is crucial for fostering trust, innovation, and seamless user experiences in the financial sector. AI and Integration Automation play a significant role in achieving this by enhancing security measures and ensuring regulatory adherence. Cloud Security Web’s expertise in API integration and cloud security helps businesses navigate this complex landscape, offering a comprehensive suite of services to address challenges and optimize open banking operations.

Understanding Open Banking

Open banking is a financial services concept that allows third-party developers to access banks’ data through Application Programming Interfaces (APIs). This data sharing enables the creation of new, innovative financial products and services, providing consumers and businesses with greater choice and convenience.

There are several benefits of open banking for consumers and businesses. For consumers, open banking enables them to access a wide range of financial services, such as budgeting tools, savings accounts, and loan products, all through a single platform. Businesses, on the other hand, can leverage open banking to streamline their financial operations, gain better insights into their cash flow, and access tailored financial products and services.

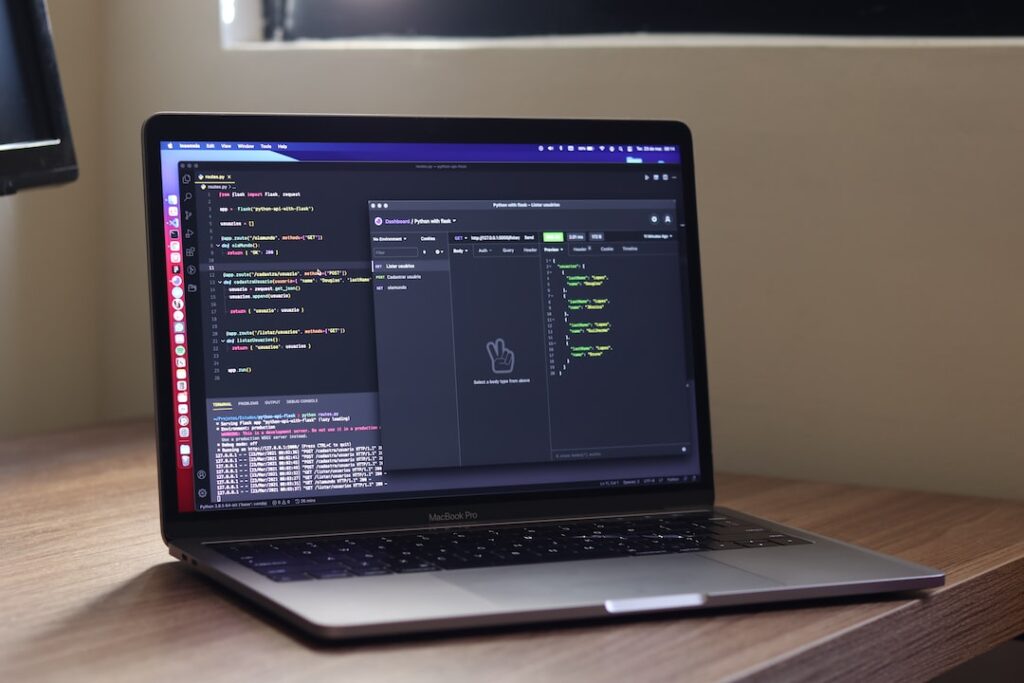

APIs play a critical role in driving open banking innovation. By facilitating secure data sharing between banks and third-party providers, APIs enable the development of new financial applications and services that cater to the evolving needs of consumers and businesses. As the demand for open banking grows, the importance of API integration and governance becomes increasingly evident, highlighting the need for expertise in managing and securing these connections.

Challenges in Implementing Secure Open Banking

While open banking offers numerous benefits, it also presents several challenges that need to be addressed to ensure security, compliance, and seamless functionality. These challenges include:

Security Concerns: The increased sharing of sensitive financial data between banks and third-party providers through open APIs raises concerns about data privacy and security. The risk of cyberattacks, data breaches, and fraud must be mitigated to protect both consumers and businesses. Implementing robust security measures, such as encryption, access controls, and continuous monitoring, is essential for safeguarding sensitive information and ensuring trust in open banking ecosystems.

Compliance with Regulatory Requirements: Open banking is subject to various regulations, such as the European Union’s Revised Payment Services Directive (PSD2) and the United Kingdom’s Open Banking Initiative. These regulations aim to standardize and secure the sharing of financial data while promoting innovation and competition. Compliance with such regulations requires banks and third-party providers to implement specific security measures, adhere to data protection laws, and maintain transparent communication with customers.

Ensuring Reliability and Performance of APIs and Integrations: The seamless functioning of open banking depends on the reliability and performance of APIs and integrations. Ensuring that these connections are stable, secure, and efficient is a complex task that requires expertise in API integration and governance. Continuous monitoring and optimization of APIs, as well as rigorous testing and quality assurance, are necessary to guarantee optimal performance and prevent disruptions to banking services.

Addressing these challenges is critical for the successful implementation of secure and compliant open banking. By leveraging AI and Integration Automation, financial institutions can enhance their security measures, ensure regulatory compliance, and optimize the performance of their APIs and integrations, paving the way for a secure and innovative open banking ecosystem.

AI and Integration Automation Solutions for Secure Open Banking

AI and Integration Automation offer a wide range of solutions to enhance the security, compliance, and performance of open banking ecosystems. Some of the key solutions include:

AI-driven security measures: AI technologies can help identify and prevent potential security threats in real-time by analyzing patterns, detecting anomalies, and predicting potential breaches. Machine learning algorithms can be used to monitor user behavior and flag suspicious activities, while natural language processing can help analyze communication patterns for signs of fraud. By implementing AI-driven security measures, financial institutions can enhance the overall security of their open banking ecosystems and protect sensitive customer data.

Automated compliance checks: Ensuring compliance with regulatory requirements is a complex and time-consuming task. AI and Integration Automation can simplify this process by automating compliance checks and monitoring activities. For instance, machine learning algorithms can analyze data to ensure adherence to data protection laws, while automated reporting tools can help generate regulatory reports with minimal manual intervention. This not only reduces the risk of non-compliance but also frees up valuable resources for other critical tasks.

Enhanced performance monitoring and optimization: AI and Integration Automation can help improve the performance of APIs and integrations by continuously monitoring and analyzing their functionality. Machine learning algorithms can identify performance bottlenecks, optimize resource allocation, and suggest improvements to API design and implementation. By leveraging these advanced technologies, financial institutions can ensure the reliability and efficiency of their open banking ecosystems, resulting in seamless user experiences and reduced operational costs.

Overall, AI and Integration Automation offer an array of solutions to address the challenges associated with secure open banking. By implementing these cutting-edge technologies, financial institutions can enhance the security, compliance, and performance of their open banking operations, paving the way for a more innovative and secure financial ecosystem.

Cloud Security Web’s Approach to Secure Open Banking

To address the challenges associated with secure and compliant open banking, Cloud Security Web offers a comprehensive suite of services and solutions. These services focus on assessing API integration landscapes, providing access to an integration best practices library, and implementing security-first pipelines and API quality assurance.

Cloud Security Web begins by evaluating the API integration landscapes of financial institutions. This assessment process involves determining the scope of the assessment, gathering relevant information about the APIs and integrations, evaluating their performance, assessing their reliability, and checking their security measures. Based on the findings, Cloud Security Web identifies areas for improvement and provides recommendations to enhance the security, compliance, and performance of the open banking ecosystem.

As part of its services, Cloud Security Web also grants access to an integration best practices library. This library serves as a valuable resource for financial institutions, providing insights into industry best practices for API integration and governance. By leveraging the knowledge contained in this library, organizations can optimize their open banking operations and ensure the seamless functionality of their APIs and integrations.

Finally, Cloud Security Web emphasizes security-first pipelines and API quality assurance. With a focus on security-first approaches, the company helps organizations implement robust security measures and ensure compliance with relevant regulations. Moreover, Cloud Security Web’s API quality assurance services ensure that APIs and integrations are tested rigorously and continuously monitored for optimal performance and reliability.

By adopting Cloud Security Web’s approach to secure open banking, financial institutions can effectively address the challenges associated with security, compliance, and performance, paving the way for a more innovative and secure open banking ecosystem.

Benefits of Adopting AI and Integration Automation in Open Banking

Embracing AI and Integration Automation in open banking can result in numerous advantages for financial institutions, their customers, and the overall financial ecosystem. These benefits span across improved security and compliance, streamlined operations and cost savings, and enhanced customer experience.

Improved Security and Compliance

AI and Integration Automation can significantly enhance security measures in open banking by detecting and mitigating potential threats in real-time. By analyzing patterns, identifying anomalies, and predicting breaches, AI technologies can protect sensitive financial data and ensure compliance with relevant regulations. As a result, financial institutions can foster trust and confidence among their customers and partners while minimizing the risk of non-compliance penalties.

Streamlined Operations and Cost Savings

Implementing AI and Integration Automation in open banking can streamline various operational processes, leading to cost savings and increased efficiency. For instance, automated compliance checks and monitoring activities can reduce manual labor and associated costs, while AI-driven performance optimization can ensure optimal resource allocation. By automating various tasks, financial institutions can focus on their core business objectives and allocate resources more effectively, resulting in long-term operational benefits.

Enhanced Customer Experience

AI and Integration Automation can also significantly improve the customer experience in open banking. By ensuring the seamless functionality of APIs and integrations, these technologies can offer users a more efficient and convenient way to access financial services. Furthermore, AI-driven tools like chatbots and personalized recommendations can enhance customer engagement and satisfaction, fostering loyalty and long-term growth in the open banking ecosystem.

In conclusion, adopting AI and Integration Automation in open banking can yield considerable benefits for financial institutions, customers, and the broader financial sector. By embracing these technologies, organizations can enhance security, streamline operations, and improve customer experiences, ultimately paving the way for a more innovative and secure open banking future.

The Future of Open Banking with AI and Integration Automation

As open banking continues to evolve, AI and Integration Automation will play an increasingly important role in shaping its future. The integration of these technologies promises to bring about significant advancements in the financial sector, driving innovation and growth in the open banking ecosystem.

Emerging Trends and Technologies

New trends and technologies are constantly emerging in the realm of open banking, with AI and Integration Automation at the forefront of this evolution. The development of advanced machine learning algorithms, natural language processing techniques, and intelligent automation tools holds the potential to revolutionize the way financial institutions interact with their customers, partners, and regulators. By embracing these cutting-edge technologies, organizations can stay ahead of the competition and ensure their place in the rapidly evolving open banking landscape.

The Potential for Further Innovation and Growth

AI and Integration Automation not only address the current challenges of security, compliance, and performance in open banking but also open up new avenues for innovation and growth. Financial institutions that successfully harness the power of these technologies can develop novel products and services, offer personalized experiences to their customers, and optimize their operations for greater efficiency and cost savings. As the open banking ecosystem continues to mature, AI and Integration Automation will undoubtedly play a critical role in shaping its future, unlocking new opportunities and paving the way for a more secure, efficient, and customer-centric financial landscape.

Conclusion

In conclusion, achieving secure and compliant open banking is of paramount importance for financial institutions, as it fosters trust, drives innovation, and enhances user experiences. AI and Integration Automation technologies play a crucial role in addressing the challenges associated with secure open banking, offering advanced solutions for improving security, ensuring regulatory compliance, and optimizing API and integration performance.

Organizations seeking to navigate the complex landscape of open banking should consider leveraging the expertise and services offered by Cloud Security Web. With a focus on API integration and cloud security, Cloud Security Web provides comprehensive solutions for assessing API integration landscapes, accessing an integration best practices library, and implementing security-first pipelines and API quality assurance. By partnering with Cloud Security Web, financial institutions can harness the power of AI and Integration Automation to create a more secure, efficient, and customer-centric open banking ecosystem.

Empower Your Open Banking

As you strive to achieve secure and compliant open banking, consider the expertise and services offered by Cloud Security Web. To learn more about their API integration and cloud security services, visit cloudsecurityweb.com. Explore the integration best practices library and other resources available to help you achieve secure open banking. For expert assistance in implementing AI and Integration Automation solutions for open banking, don’t hesitate to contact Cloud Security Web.