Finance Automation: The Role of Secure API Integrations

Modern businesses thrive on finance automation, streamlining complex processes and driving efficiency. Crucial to this transformation, APIs facilitate seamless communication between disparate systems, enabling real-time data exchange and unlocking the potential for powerful financial automation. However, the success of finance automation relies on secure API integrations, safeguarding sensitive financial information and ensuring compliance with industry regulations.

Understanding API Integrations in Finance Automation

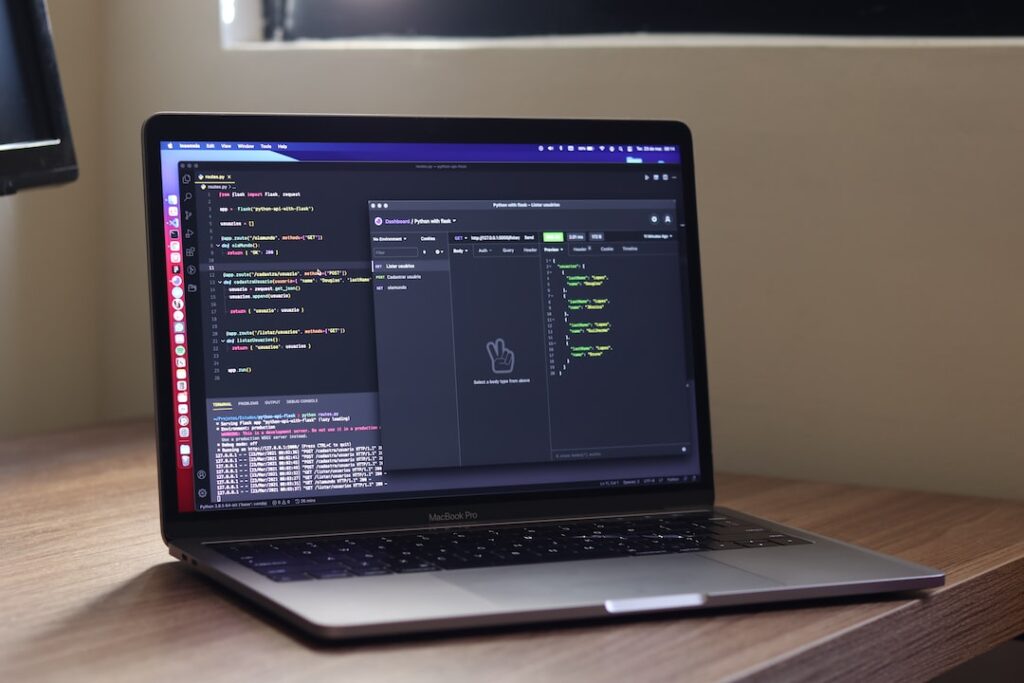

Application Programming Interfaces (APIs) play a pivotal role in the world of finance automation. These critical components enable seamless communication between various systems, laying the foundation for efficient and streamlined financial processes. In this section, we will explore the definition of APIs, how they facilitate communication, and examples of finance automation processes driven by APIs.

APIs are essentially a set of rules and protocols that allow different software applications to communicate with each other. In the context of finance, APIs are the bridge that connects disparate financial systems, enabling them to share data and functionalities in real-time. This communication lays the groundwork for automating a wide range of financial processes, streamlining operations, and improving decision-making.

APIs unlock the potential for finance automation by establishing connections between various systems, such as accounting software, payment gateways, and banking platforms. This seamless integration allows for the automation of tasks like invoice generation, payment processing, and financial reporting. By sharing data and functionality across these systems, businesses can eliminate manual processes, reduce human errors, and optimize their financial workflows.

Examples of finance automation processes driven by APIs include:

- Automated invoice processing: APIs can integrate accounting software with invoicing platforms, enabling businesses to generate, send, and track invoices automatically.

- Real-time financial data synchronization: APIs can connect financial systems like ERP and CRM platforms, allowing for real-time data sharing and synchronization across multiple platforms.

- Automated payment processing: APIs can integrate payment gateways with e-commerce platforms, streamlining payment processing and enhancing the customer experience.

- Automated financial reporting: APIs can connect accounting software with reporting tools, enabling businesses to generate real-time financial reports with minimal manual intervention.

In conclusion, API integrations are the backbone of finance automation, connecting disparate systems and facilitating seamless communication. By leveraging APIs, businesses can streamline financial processes, improve decision-making, and drive efficiency across their organization.

Top Benefits of Secure API Integrations in Finance Automation

Secure API integrations play a crucial role in finance automation, driving efficiency and improving overall business operations. By leveraging secure API integrations, businesses can unlock numerous benefits that transform their financial processes. Let’s explore the top advantages of secure API integrations in finance automation.

Increased Productivity Through Automation One of the primary benefits of secure API integrations is increased productivity. By automating various financial tasks, businesses can eliminate time-consuming manual processes and focus on higher-value activities. Automation streamlines operations, leading to faster decision-making and improved overall efficiency.

Enhanced Transparency in Financial Operations Secure API integrations enhance transparency in financial operations by providing real-time access to accurate data across multiple systems. This increased visibility helps businesses monitor their financial performance, identify potential issues, and make informed decisions based on up-to-date information.

Improved Reporting and Analysis Capabilities API integrations facilitate the seamless flow of financial data between systems, enabling businesses to generate real-time reports and perform advanced analysis. With improved reporting and analysis capabilities, organizations can gain valuable insights into their financial performance and make data-driven decisions to optimize their operations.

Time-Saving and Elimination of Manual Data Entry By automating financial processes, secure API integrations help businesses save time and reduce the risk of human error associated with manual data entry. Automated data exchange ensures accurate information flows between systems, minimizing discrepancies and the need for manual intervention.

Reduced Errors and Improved Data Accuracy Lastly, secure API integrations contribute to reduced errors and improved data accuracy in financial operations. By streamlining processes and ensuring data consistency across platforms, businesses can minimize the risk of costly errors and maintain high levels of data integrity.

In conclusion, secure API integrations offer numerous benefits for finance automation, driving productivity, enhancing transparency, and improving overall business operations. By leveraging secure API integrations, businesses can transform their financial processes and optimize their performance in today’s competitive landscape.

Challenges in Securing API Integrations for Finance Automation

While API integrations offer numerous benefits for finance automation, they also present unique challenges in ensuring the security and reliability of the integrated systems. In this section, we will discuss some of the key challenges businesses face in securing API integrations for finance automation and the steps they can take to address these concerns.

Data Privacy and Compliance with Regulatory Standards One of the primary challenges in securing API integrations for finance automation is ensuring data privacy and compliance with regulatory standards. Financial data is often sensitive and subject to strict regulations, such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS). Businesses need to implement robust security measures and best practices to safeguard the data exchanged via API integrations and ensure compliance with these standards.

Protecting Sensitive Financial Information from Unauthorized Access Another challenge in securing API integrations for finance automation is protecting sensitive financial information from unauthorized access. Cybercriminals are constantly seeking ways to exploit vulnerabilities in API integrations to gain access to valuable financial data. Businesses need to adopt a security-first approach when developing and integrating APIs, employing advanced security measures such as encryption, access control, and authentication to prevent unauthorized access to sensitive information.

Maintaining the Performance and Reliability of API Integrations Lastly, maintaining the performance and reliability of API integrations is a significant challenge for businesses leveraging finance automation. API integrations need to be constantly monitored, maintained, and updated to ensure their ongoing performance and security. Failure to do so can result in system downtime, data breaches, and loss of customer trust. Businesses need to invest in continuous monitoring and maintenance solutions, such as LogTrace360, to ensure the performance and reliability of their API integrations.

In conclusion, securing API integrations for finance automation presents several challenges, including data privacy and compliance, protection of sensitive information, and maintaining performance and reliability. By adopting a security-first approach and partnering with experienced providers like Cloud Security Web, businesses can overcome these challenges and leverage secure API integrations to drive efficiency and transform their financial processes.

Best Practices for Securing API Integrations in Finance Automation

As businesses increasingly rely on finance automation and API integrations, it becomes crucial to implement best practices that ensure security and compliance. In this section, we will discuss four essential best practices for securing API integrations in finance automation. By following these guidelines, organizations can protect their sensitive financial data, maintain regulatory compliance, and enjoy the benefits of seamless and secure finance automation.

Implementing Robust Access Control and Authentication Mechanisms One of the first steps in securing API integrations is to implement robust access control and authentication mechanisms. This involves establishing strict protocols for granting access to APIs, such as multi-factor authentication and role-based access controls. By restricting access to authorized users and applications, businesses can minimize the risk of unauthorized access to sensitive financial data.

Regularly Monitoring and Auditing API Usage and Activity Monitoring and auditing API usage and activity is essential for maintaining security and compliance. By keeping a close eye on API interactions, businesses can identify potential security threats, unusual activity patterns, and unauthorized access attempts. Tools like LogTrace360, an AI-powered logging and tracing solution, can help organizations with continuous monitoring and auditing of their API integrations.

Ensuring Up-to-Date Security Measures and Timely Vulnerability Patching Another best practice for securing API integrations is to ensure that all security measures are up-to-date and vulnerabilities are patched promptly. This involves regularly updating API libraries, frameworks, and dependencies to the latest versions and applying security patches as soon as they become available. By staying current with security updates, businesses can protect their API integrations from known vulnerabilities and emerging threats.

Adopting a Security-First Approach in API Development and Integration Lastly, adopting a security-first approach in API development and integration is key to ensuring the overall security of finance automation processes. This means prioritizing security from the initial stages of API design, development, and integration. By focusing on security throughout the API lifecycle, businesses can minimize the risk of security breaches and ensure the safe and reliable operation of their finance automation processes.

In conclusion, implementing these best practices for securing API integrations in finance automation can help businesses safeguard their sensitive financial data, maintain regulatory compliance, and enjoy the benefits of seamless and secure finance automation. By partnering with experienced providers like Cloud Security Web, organizations can access the expertise and resources needed to implement these best practices and protect their API integrations.

How Cloud Security Web Can Help Secure Your Finance Automation API Integrations

Cloud Security Web is a leading provider of advanced solutions for API integration and cloud security. With a focus on professional, informative, and technology-driven services, Cloud Security Web is dedicated to helping businesses secure their finance automation API integrations. In this section, we will explore how Cloud Security Web can assist organizations in securing their API integrations for finance automation, ensuring optimal performance, reliability, and security.

First and foremost, Cloud Security Web boasts expertise in API integration and cloud security. The company’s experience in the field of API and integration governance enables them to assess, evaluate, and improve the security of clients’ finance automation API integrations. This expertise, combined with a deep understanding of cutting-edge technologies, makes Cloud Security Web a trusted partner for organizations seeking to strengthen their finance automation processes.

Cloud Security Web also offers access to the Integration Best Practices Library. This resource provides a wealth of information on API integration and security best practices, helping businesses to optimize their finance automation processes and maintain compliance with industry regulations. By leveraging the insights available in the Integration Best Practices Library, organizations can ensure that their API integrations are secure and efficient.

Additionally, Cloud Security Web provides comprehensive services, including staff augmentation, security-first pipelines, and API quality assurance. Through these offerings, the company supports businesses in achieving their finance automation goals by providing expert resources, advanced security measures, and ongoing quality assurance. This comprehensive approach ensures that clients’ API integrations remain secure, reliable, and efficient at all times.

Finally, Cloud Security Web follows a proven process for assessing and improving API performance, reliability, and security. This process involves determining the scope of the assessment, gathering relevant information about the APIs and integrations, evaluating their performance, assessing their reliability, checking their security measures, and identifying areas for improvement based on the assessment findings. By leveraging this proven approach, Cloud Security Web ensures that businesses can confidently rely on their finance automation API integrations for secure, efficient, and effective operations.

In conclusion, Cloud Security Web is a valuable partner for businesses seeking to secure their finance automation API integrations. With their expertise, resources, and proven processes, the company provides advanced solutions that enable organizations to optimize their financial processes while maintaining security and compliance. To learn more about Cloud Security Web’s API integration and security services, visit [insert website URL].

Embrace Finance Automation Security

Secure API integrations play a critical role in successful finance automation, enabling businesses to streamline their financial processes while safeguarding sensitive data. By adopting best practices and partnering with experienced providers like Cloud Security Web, organizations can ensure the security and reliability of their API integrations. Don’t miss the opportunity to improve your finance automation processes – learn more about Cloud Security Web’s API integration and security services at https://cloudsecurityweb.com .